The Allure of M&A in the Ladies’ Footwear Industry: A Comprehensive Analysis

Related Articles: The Allure of M&A in the Ladies’ Footwear Industry: A Comprehensive Analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Allure of M&A in the Ladies’ Footwear Industry: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Allure of M&A in the Ladies’ Footwear Industry: A Comprehensive Analysis

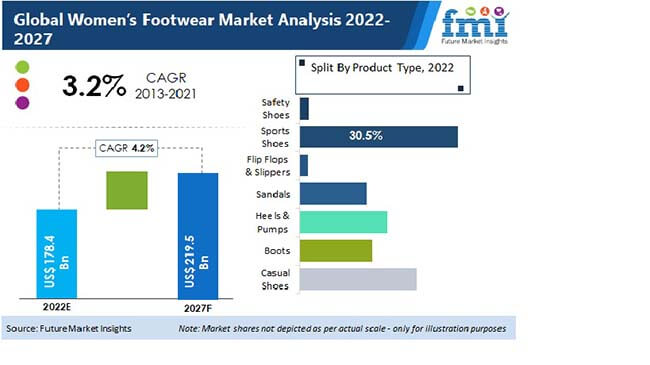

The world of ladies’ footwear is a dynamic and ever-evolving landscape, characterized by a constant interplay of trends, innovation, and consumer demand. In this intricate ecosystem, mergers and acquisitions (M&A) play a pivotal role, shaping the industry’s trajectory and influencing the brands that adorn women’s feet.

Understanding the Landscape:

The ladies’ footwear market is a multi-billion dollar industry, with a diverse range of players catering to a wide spectrum of consumer preferences. From high-end luxury brands to mass-market retailers, each segment exhibits unique characteristics and challenges. M&A activity in this sector reflects the evolving dynamics of the market, driven by factors such as:

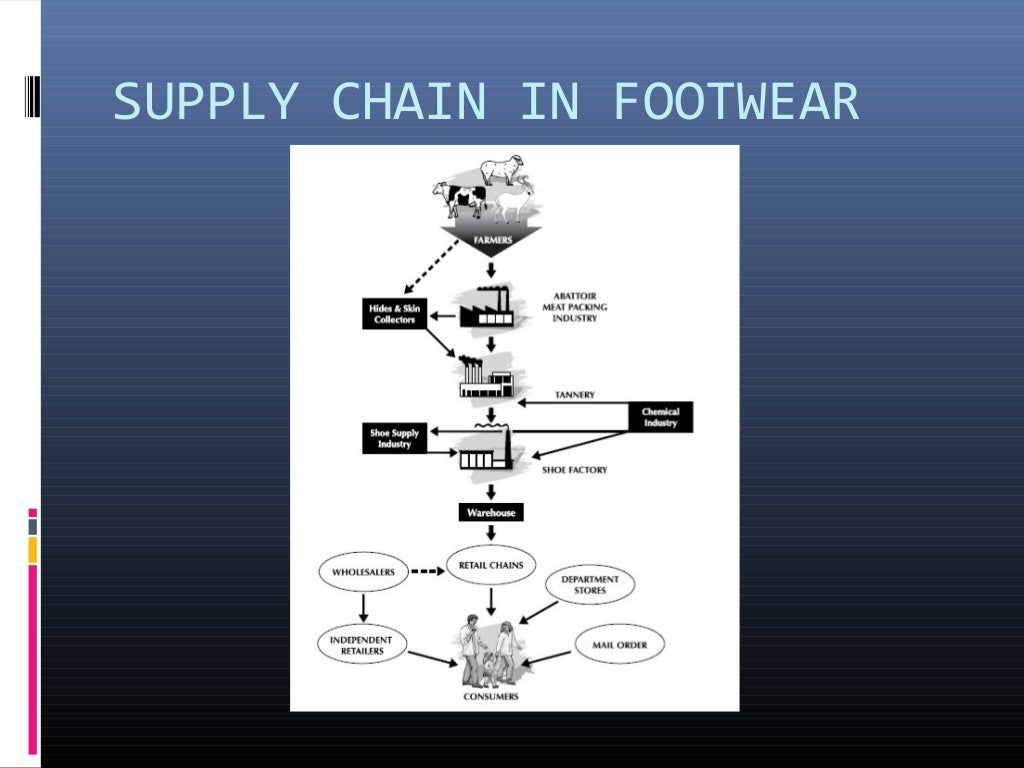

- Consolidation: As competition intensifies, companies seek to achieve economies of scale and enhance their market position through mergers and acquisitions. This allows them to leverage shared resources, optimize production, and streamline distribution networks.

- Expansion into New Markets: M&A provides a strategic pathway for companies to enter new geographical territories, tap into emerging markets, and diversify their product offerings. This can involve acquiring established brands with a strong presence in specific regions or acquiring smaller companies with innovative product lines.

- Innovation and Technology: The footwear industry is constantly evolving, with technological advancements driving innovation in materials, manufacturing processes, and design. M&A enables companies to acquire cutting-edge technologies and expertise, accelerating their product development and staying ahead of the curve.

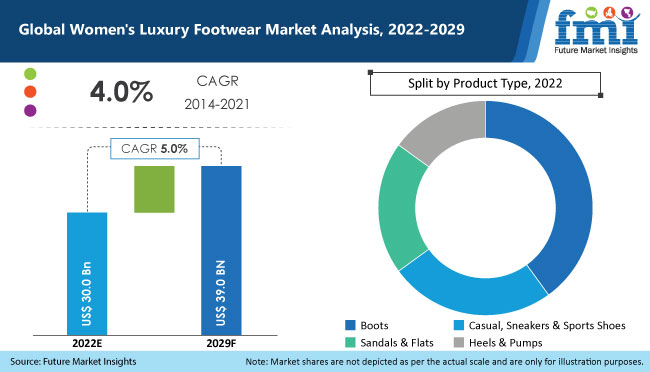

- Brand Building: Acquisitions can be instrumental in bolstering brand recognition and enhancing brand equity. By acquiring established brands with a loyal customer base, companies can expand their reach and tap into new customer segments.

Types of M&A Deals in the Ladies’ Footwear Industry:

- Horizontal Mergers: These involve the combination of two companies operating in the same market segment, such as two high-end shoe manufacturers. This strategy aims to achieve economies of scale, increase market share, and eliminate competition.

- Vertical Mergers: This type of acquisition involves companies operating at different stages of the value chain, such as a shoe manufacturer acquiring a retail chain. This strategy seeks to gain control over the supply chain, reduce costs, and improve efficiency.

- Conglomerate Mergers: This involves the combination of companies operating in unrelated industries. While less common in the ladies’ footwear industry, this strategy can offer diversification and risk mitigation.

Benefits of M&A in the Ladies’ Footwear Industry:

- Increased Market Share: Mergers and acquisitions can significantly increase a company’s market share, enabling it to gain a dominant position in the industry.

- Enhanced Brand Recognition: Acquiring established brands with a strong reputation can enhance a company’s brand recognition and visibility in the market.

- Access to New Markets: M&A allows companies to enter new geographical territories and expand their reach to untapped customer segments.

- Innovation and Product Development: Acquiring companies with innovative technologies or product lines can accelerate a company’s product development process and introduce new offerings to the market.

- Cost Reduction and Efficiency: Mergers and acquisitions can streamline operations, reduce costs, and improve efficiency through shared resources and optimized processes.

Challenges and Considerations:

While M&A offers numerous benefits, it is not without its challenges:

- Integration: Integrating two companies can be complex and time-consuming, requiring careful planning and execution to avoid disruption and ensure a smooth transition.

- Cultural Differences: Merging companies with distinct cultures can lead to conflicts and hinder integration. It is crucial to address cultural differences and create a cohesive work environment.

- Regulatory Approval: M&A transactions may require regulatory approval, which can be a lengthy and complex process, involving antitrust reviews and other legal considerations.

- Valuation: Determining the fair value of the target company is critical for a successful acquisition. Miscalculations can lead to financial losses and damage the acquiring company’s reputation.

Case Studies:

- The Acquisition of Jimmy Choo by Michael Kors: In 2017, Michael Kors acquired the luxury footwear brand Jimmy Choo, expanding its portfolio and strengthening its presence in the high-end market. This move allowed Michael Kors to tap into a new customer base and diversify its product offerings.

- The Merger of Reebok and Adidas: In 1985, Adidas acquired Reebok, creating a dominant force in the athletic footwear market. This merger allowed Adidas to expand its product line and target a wider range of consumers, particularly in the fitness and athletic wear segments.

FAQs about M&A in the Ladies’ Footwear Industry:

Q: What are the most common drivers of M&A in the ladies’ footwear industry?

A: The most common drivers include consolidation, expansion into new markets, innovation and technology, and brand building.

Q: What are the different types of M&A deals in the ladies’ footwear industry?

A: The main types include horizontal mergers, vertical mergers, and conglomerate mergers.

Q: What are the key benefits of M&A in the ladies’ footwear industry?

A: Benefits include increased market share, enhanced brand recognition, access to new markets, innovation and product development, and cost reduction and efficiency.

Q: What are the main challenges associated with M&A in the ladies’ footwear industry?

A: Challenges include integration, cultural differences, regulatory approval, and valuation.

Tips for Success in M&A in the Ladies’ Footwear Industry:

- Conduct thorough due diligence: Carefully assess the target company’s financial performance, market position, and potential risks.

- Develop a clear integration plan: Outline the steps for integrating the target company into the acquiring company, addressing cultural differences and potential challenges.

- Secure necessary regulatory approvals: Understand the regulatory requirements for the transaction and navigate the approval process efficiently.

- Communicate effectively: Maintain open communication with stakeholders throughout the transaction, addressing concerns and managing expectations.

Conclusion:

M&A continues to play a significant role in shaping the ladies’ footwear industry, driving consolidation, innovation, and growth. By understanding the dynamics of the market, the benefits and challenges of M&A, and the key considerations for successful transactions, companies can leverage this powerful tool to achieve their strategic objectives and navigate the ever-evolving landscape of ladies’ footwear.

Closure

Thus, we hope this article has provided valuable insights into The Allure of M&A in the Ladies’ Footwear Industry: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!